ventura property tax rate

Florida Department of State. The exact property tax levied depends on the county in South Dakota the property is located in.

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Tax amount varies by county.

. The median property tax in Fresno County California is 1666 per year for a home worth the median value of 257000. Mississippi has one of the lowest median property tax rates in the United States with only three states collecting a lower median property tax than Mississippi. Revenue Taxation Codes.

Revenue Taxation Codes. The median property tax in Nevada is 084 of a propertys assesed fair market value as property tax per year. Gwinnett County collects on average 1 of a propertys assessed fair market value as property tax.

This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom. Austin County collects on average 13 of a propertys assessed fair market value as property tax. Nevadas median income is 66086 per year so the median yearly property tax paid by.

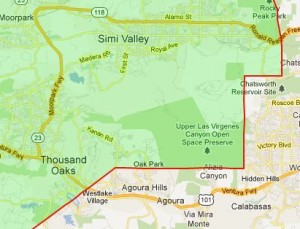

Fresno County has one of the highest median property taxes in the United States and is ranked 658th of the 3143 counties in order of median property taxes. Please check with the local county assessor before. Orange San Mateo and Ventura.

Learn who needs to pay as well as how and when they pay real property taxes in California. Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected. Mississippis median income is 45925 per year so the median yearly property.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Tax amount varies by county. Florida Department of State Division of Corporations.

Gwinnett County has one of the highest median property taxes in the United States and is ranked 479th of the 3143 counties in order of median property taxes. Austin County has one of the highest median property taxes in the United States and is ranked 504th of the 3143 counties in order of median property taxes. The median property tax in New York is 123 of a propertys assesed fair market value as property tax per year.

South Dakota is ranked 23rd of the 50 states for property taxes as a percentage of median income. This list is subject to change. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation.

The property tax rate in the county is 078. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Tax amount varies by county.

Fresno County collects on average 065 of a propertys assessed fair market value as property tax. Alabama has one of the lowest median property tax rates in the United States with only one states collecting a lower median property tax than Alabama. West Virginias median income is 44940 per year so the median yearly property tax.

The seller may be responsible for a prorated portion of the taxes. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The median property tax in Austin County Texas is 1903 per year for a home worth the median value of 146500.

Colorado is ranked number thirty out of the fifty states in order of the average amount of property taxes collected. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. The median property tax in Connecticut is 163 of a propertys assesed fair market value as property tax per year.

Property and Casualty insurance services offered through NerdWallet Insurance Services Inc. CA resident license no. Connecticuts median income is 85993 per year so the median yearly.

This article will show you some of the most common property tax exemptions for seniors and how to determine whether youre eligible for them. Oklahoma has one of the lowest median property tax rates in the United States with only six states collecting a lower median property tax than Oklahoma. Engaged Dallasites read FrontBurner.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. Alabamas median income is 51014 per year so the median yearly property tax paid by. Lincoln County collects the highest property tax in South Dakota levying an average of 146 of median home value yearly in property taxes while.

TAX DAY IS APRIL 17th. California Propositions 60 and 90. Your account has been locked.

New York has one of the highest average property tax rates in the country with only three states levying higher property taxes. A daily conversations and analysis of Dallas news politics urbanism history public safety and more. West Virginia has one of the lowest median property tax rates in the United States with only two states collecting a lower median property tax than West Virginia.

The median property tax in West Virginia is 46400 per year049 of a propertys assesed fair market value as property tax per year. Propositions 60 and 90 are pieces of legislation that allow homeowners 55 or older to move into a new home without substantially increasing their property tax obligation. Property Tax Tools - Free Property Tax Rate Calculator.

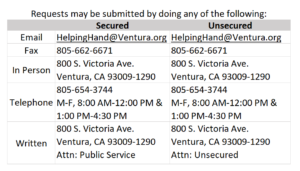

Tax amount varies by county. Unsecured personal property tax bills for a business a boat or an airplane are the full responsibility of the assessee of record as of the January 1 lien date. Please call Wyndham Rewards Member Services at 844 405-4141.

The median property tax in Alabama is 39800 per year033 of a propertys assesed fair market value as property tax per year. OK92033 Property Casualty Licenses NerdWallet 55 Hawthorne St. The median property tax in Colorado is 06 of a propertys assesed fair market value as property tax per year.

The median property tax in Gwinnett County Georgia is 1950 per year for a home worth the median value of 194200. Looking for information on the California property tax rate. New Yorks median income is 74777 per year so the median yearly property.

Connecticut has one of the highest average property tax rates in the country with only one states levying higher property taxes. The median property tax in Oklahoma is 79600 per year074 of a propertys assesed fair market value as property tax per year. Start filing your tax return now.

Oklahomas median income is 52889 per year so the median yearly property tax paid by. The median property tax in Mississippi is 50800 per year052 of a propertys assesed fair market value as property tax per year. Determining how the real property tax is calculated and the proper amount is important otherwise.

Colorados median income is 71154 per year so the median yearly property tax paid by.

Tax Collector Faq S Ventura County

County Of Ventura Webtax Search For Property

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Fidelity National Title Ventura County Facebook

County Of Ventura Webtax Search For Property

Ventura And Los Angeles County Property And Sales Tax Rates

Los Angeles County Ca Property Tax Search And Records Propertyshark

Understanding California S Property Taxes

If You Re Over 65 Here S One Of The Best Kept Secrets In Mass The Boston Globe

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara

New Homes In Palmetto The Ventura Plan M I Homes

Where Can I Pay My Ventura County Property Taxes During Covid

2022 Best Places To Buy A House In Ventura County Ca Niche

Treasurer Tax Collector Ventura County

Ventura And Los Angeles County Property And Sales Tax Rates

Ventura And Los Angeles County Property And Sales Tax Rates