nevada military retirement taxes

In a bill this year that would exempt up to 35000 a year in military retirement income from state income tax was passed in February 2022 by the state House. 80 - 99 disabled - 21900 assessed value.

The States That Won T Tax Military Retirement In 2022

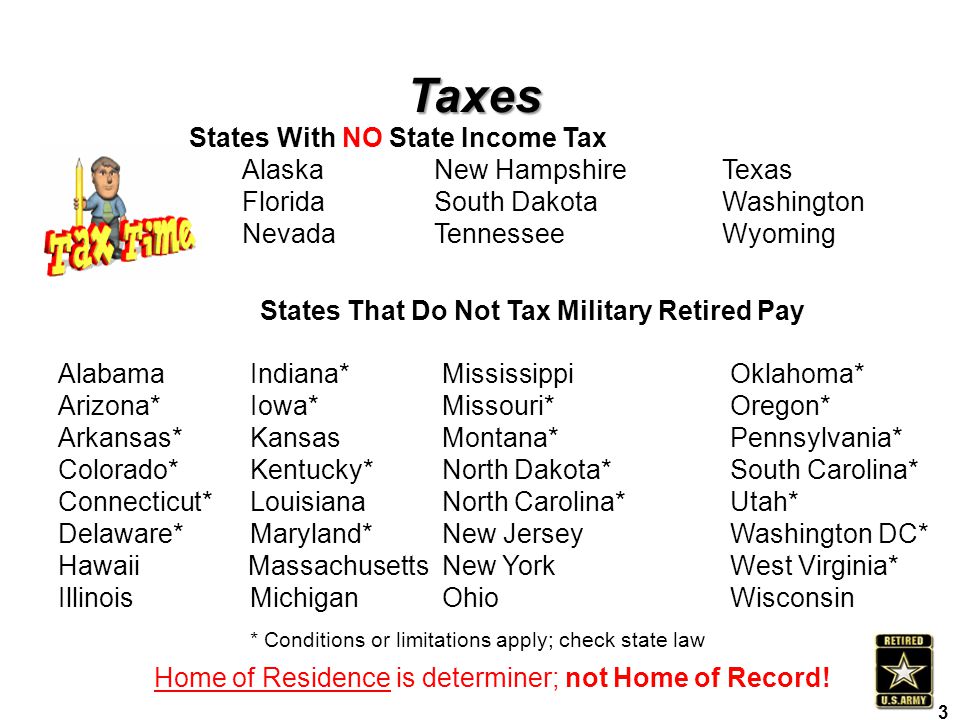

In fact the state has no taxes on income or Social Security benefits.

. States exempt military retirement pay from taxes while 13 states plus DC have some type of exemption for military retirees. In fact the state has no taxes on income or Social Security benefits. The 202122 fiscal year amounts.

The amount of exemption is dependent upon the degree. An additional 21 states dont tax military retirement pay but do have state personal income tax which is why you might consider them the best tax-friendly states for military. An additional 21 states dont tax military retirement pay but do have state personal income tax which is why.

Sales tax is the most common tax you encounter on a day to day basis and impacts your cost-of-living directly. Alaska Florida Nevada South Dakota Texas. Finally Nevada is the 29 overall most veteran friendly state by population.

An annual tax exemption is available to any Nevada resident veteran with wartime service. An additional 21 states dont tax military retirement pay but do have state personal income tax which is why. According to VA published statistics for FY 2021 a total of 218052 retired.

Does Nevada Tax Military Retirement. No Nevada does not tax retirement income. The average amount of.

The statewide sales tax rate for Nevada is 69. Nine states dont tax military retirement pay because they do not have a personal. This means Nevada does not tax pensions social security or retirement account income.

100 disabled - 29200 assessed value. Disabled Veterans Exemption which provides for veterans who have a permanent service-connected disability of at least 60. 60 - 79 disabled - 14600 assessed value.

Final Pay Retirement System Under this system your retired pay is computed by multiplying your final monthly base pay when you retire by 25 for every year of your service. No Nevada does not tax military retirement income as theres no state income tax in Nevada.

Nevada Military And Veterans Benefits The Official Army Benefits Website

5 Best States For Military Retirees 2023 Edition Va Claims Insider

Military Retirement And State Income Tax Military Com

Nevada Retirement Taxes And Economic Factors To Consider

Nevada Military And Veterans Benefits The Official Army Benefits Website

Nevada Military And Veterans Benefits The Official Army Benefits Website

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

5 More States Make Military Retirement Tax Free Military Com

Nevada Military And Veterans Benefits The Official Army Benefits Website

Nevada Military And Veterans Benefits An Official Air Force Benefits Website

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

Nevada Military And Veterans Benefits An Official Air Force Benefits Website

Military Retirement Pay Will Now Be Totally Exempt From State Income Tax In These Two States Military Net

Nevada Military And Veterans Benefits The Official Army Benefits Website

Moaa Colorado Lawmakers Pass Bill Reducing Taxes On Military Retirement

Nevada Military And Veterans Benefits The Official Army Benefits Website

5 Best States For Military Retirees 2023 Edition Va Claims Insider

Fort Bragg Retirement Services Information Brief Ppt Download