net operating working capital investopedia

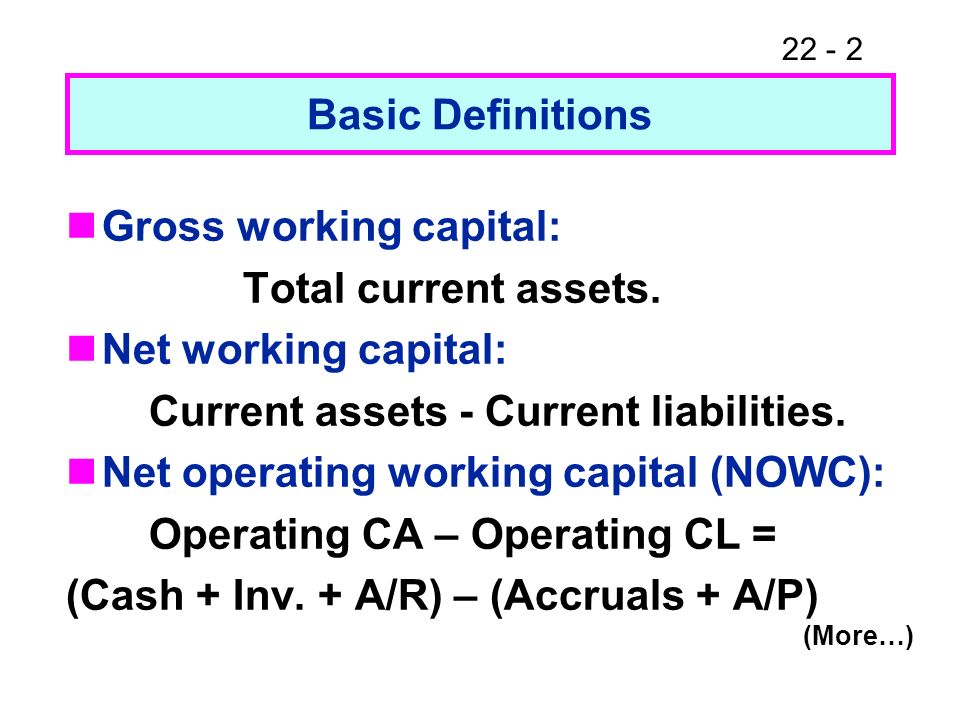

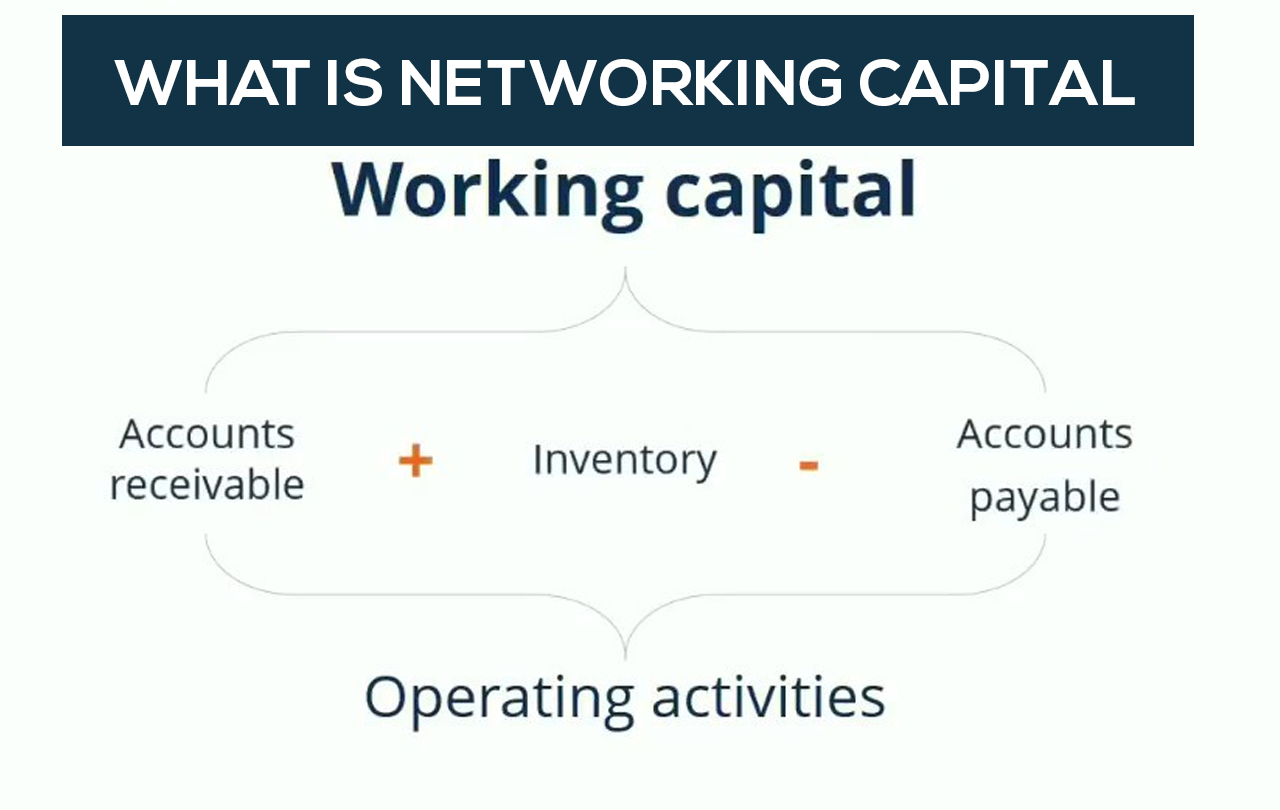

Net operating working capital NOWC is the excess of operating current assets over operating current liabilities. You can calculate net operating working capital by adding total Cash accounts receivable and inventories minus accounts payable and accrued expenses.

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

Say that Company A has 12 million in net sales over the.

. Compare The Best Rates for Working Capital Loans. It is used to measure the liquidity. Apply Now Get Low Rates.

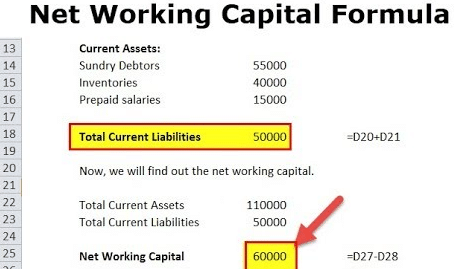

Current assets include cash. Working capital also called net working capital is the amount of money a company has available to pay its short-term expenses. Compare Top-Rated Lenders Choose Easily.

Ad Compare Top 7 Working Capital Lenders of 2022. High liquidity or a liability that is coming due within the next twelve months. To calculate total operating.

Ad Need A Business Loan But Cant Decide Who From. In essence the NOWC is part of the TOC. Start Your Investing Education.

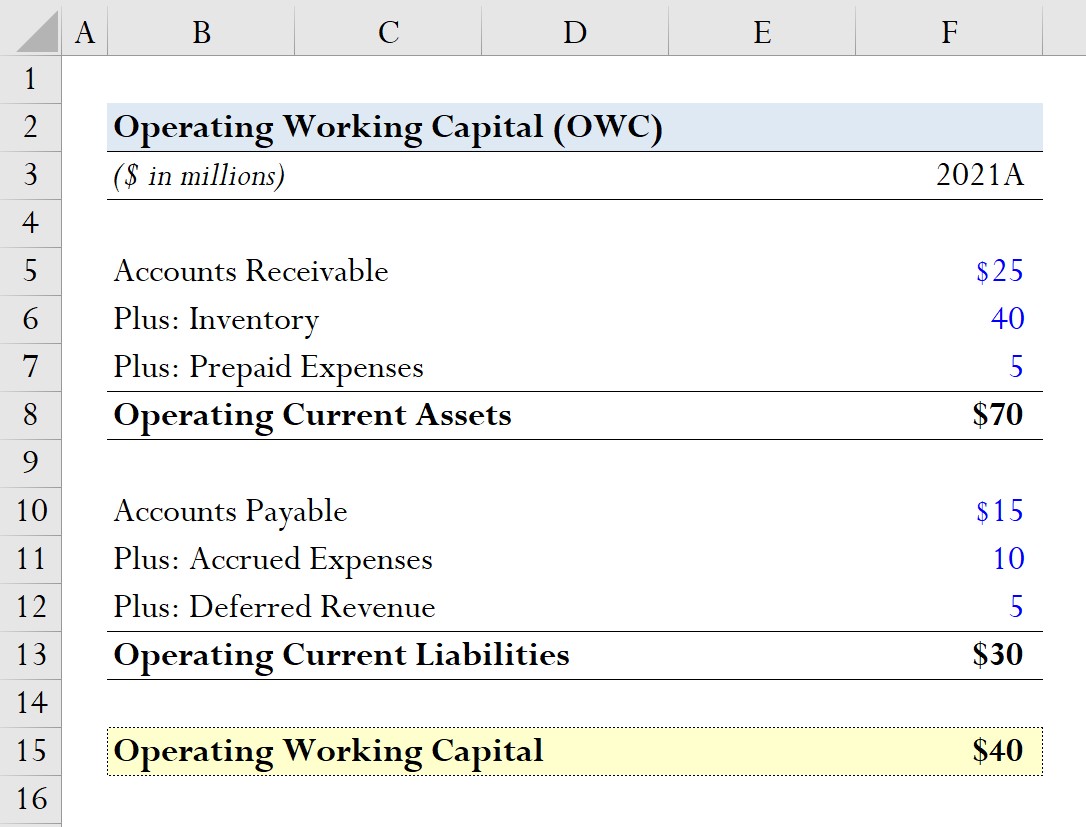

Net Operating Working Capital Operating Current Assets Operating Current Liabilities. Learn About Stocks Bonds Futures and More. What is the difference between net operating working capital and the total operating capital.

At the very top of the working capital schedule reference sales and cost of goods sold from the income statement for all relevant periods. These will be used later to. Net operating working capital is a direct measure of a companys liquidity operational efficiency and its overall financial health at least in the short-term.

Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities. Net operating working capital NOWC is a financial metric that measures a companys operating liquidity by comparing operating assets to operating liabilities. The current categorization signifies an asset that can be converted into cash within twelve months ie.

Calculate total net operating capital for Best Buy Inc. Companies that have a large amount. This metric is much more tied to cash flows than the net working.

To calculate it use the following. The traditional textbook definition of working capital refers to a companys current assets minus its current liabilities. How to Calculate Operating Working Capital.

The net operating working capital formula is calculated by subtracting working liabilities from working assets like this. A working capital adjustment occurs when a seller does not deliver the net working capital pegged by the buyer as part of the tangible asset backing required to close a transaction.

Chapter 22 Working Capital Management Ppt Video Online Download

Net Working Capital Guide Examples And Impact On Cash Flow

Working Capital Turnover Formula And Calculator

What Is Net Working Capital Daily Business

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

A Complete Guide To Net Working Capital And How To Calculate It

/workinprogress.asp_final-70bd74113f9e4701802dc825aff76437.png)

Work In Progress Wip Definition With Examples

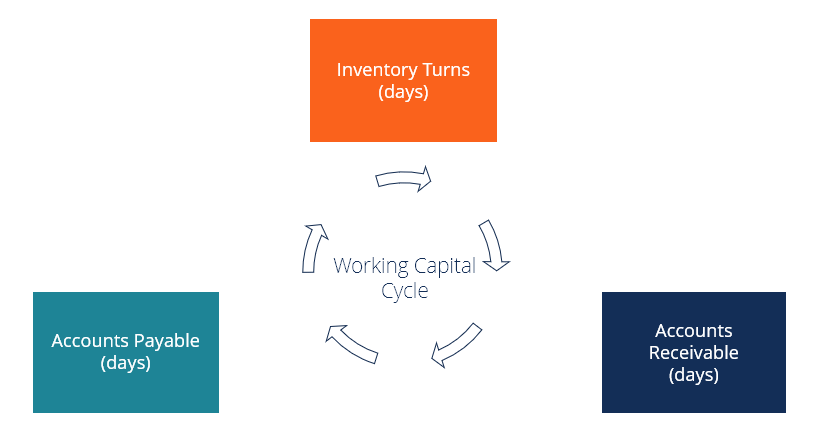

Working Capital Cycle What Is It With Calculation

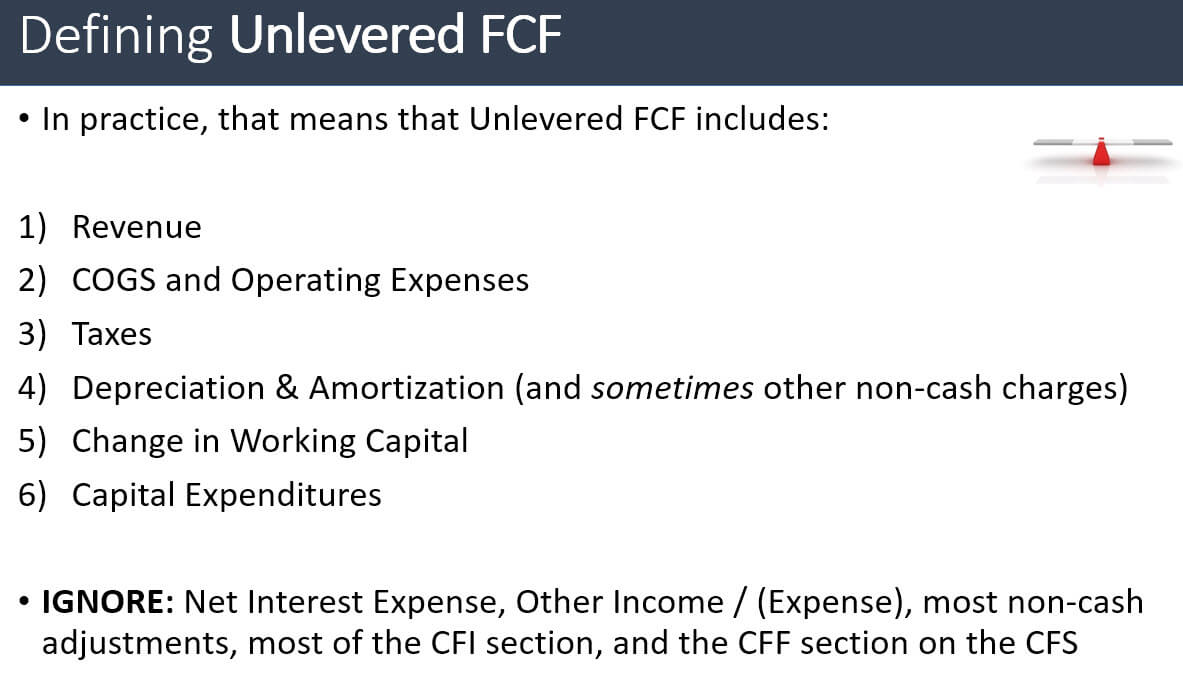

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

/Capital-final-e177751d17a642d8860382a56d51e3bc.png)

Capital Definition How It S Used Structure And Types In Business

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

Common Size Income Statement Definition And Example

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

:max_bytes(150000):strip_icc()/DSCR-b224f0db64184eae800e27598a8bc2d7.png)

How To Calculate Debt Service Coverage Ratio Dscr In Excel

Operating Assets Formula And Calculator

Operating Working Capital Owc Formula And Calculator

Working Capital Definition Formula Examples With Calculations

Working Capital Cycle Understanding The Working Capital Cycle

/dotdash_INV_final-After-Tax-Operating-Income-ATOI_Apr_2021-01-d4bfe68175d3482f9e796a8395e660e8.jpg)

After Tax Operating Income Atoi

/TermDefinitions_CFF_finalv1-f2cdc1f2ec574548a8ccf94dd8cb7cfc.png)

Cash Flow From Financing Activities Cff Formula Calculations